Rooftop solar power generation in Florida is an emerging industry that has the potential to decrease electric company profits. The FPL (Florida Power & Light) which lobby state lawmakers with records obtained by Miami Herald and Floodlight for legislation they asked them hand-deliver, shows how much this new form of energy backbone could hurt their business model currently based on selling fuel overheads like coal or natural gas plants do today.

In 2020, Florida Power & Light had a close ally in state Sen. Jennifer Bradley who sponsored their top-priority bill to make it more difficult for homeowners and businesses across the country who have installed rooftop solar panels – preventing them from offsetting costs by selling excess power back onto FPL’s grid at full retail price through a process known as net metering.

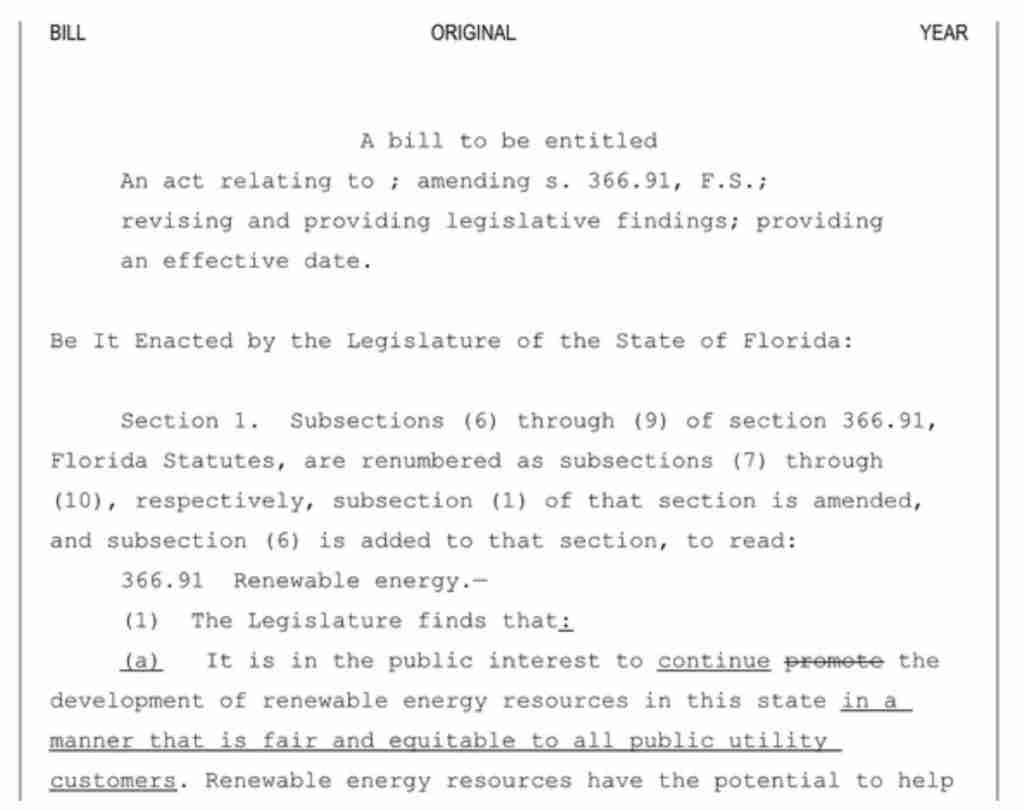

In November, the Florida Senate drafted a bill and sent it to DLG Bradley who then gave it back for review. The lobbyist representing FPL Drafted this legislation while her political advisory group received $10K from them after they saw how well-written our language was in order keep up with what’s going on at every level of government here! In fact just last month when State Rep Lawrence McClure introduced his version without any changes.

In Florida, only about 1% of the state’s more than 8 million customers sell excess energy back to utilities which equates to roughly 90,000 not including the thousands of people waiting in line to get set up with solar. However, this has driven significant rooftop solar expansion in recent years and Florida Power and Light is pushing for legislation that could seriously curtail these gains with their biggest utility having 5.5 million clients (65%), Duke Energy has 2 million, followed by TECO at 800k and many other smaller sized utility companies.

The fight against net metering is just another example of how utilities try to maintain their monopoly grip on electricity markets. They claim that this bill will devastate the business, but Solar Energy Industries Association director Will Giese says it doesn’t have much impact because people can still choose which type energy works best for them without any change or harm done under current rules — so long as they’re happy with whatever option their provider offers!

The Florida Public Service Commission has been receiving proposals from power companies on how they expect rooftop solar will affect their bottom line. One company, FPL (a utility) is arguing that because of this new technology called “distributed renewable energy” profits could be threatened by $700 million between 2019 and 2025 – which would mean less money for them; however scientists say with climate change we need these cleaner sources of electricity!

Florida Power and Light representative Chris McGrath said the organization doesn’t go against net metering however needs to see the ongoing regulation reexamined. He contended that clients with roof sun oriented are being sponsored by different clients who keep on purchasing power and pay to keep up with the power lattice.

“We basically accept roof sun oriented clients ought to pay the full expense of this venture,” McGrath said.

A long, political fight

The bill is only one front in a very long term fight against the arrangement. For quite a long time, Florida Power and Light has been perhaps the biggest supporter of regulative Florida political missions. It moved a bombed voting form correction in 2016 that would have permitted controllers to force charges and boundaries to roof sunlight based establishment. Florida Power and Light has additionally put millions into bunches with untraceable, mysterious contributors that sent off assaults on state and nearby lawmakers.

As indicated by detailing by the Orlando Sentinel, Florida Power and Light chiefs have been attached to a progression of ‘dull cash’ charities, one of which figures unmistakably in the Miami-Dade express lawyer’s examination concerning an outrage including a “phantom” Senate up-and-comer. Under the plan, an applicant with no political foundation was on the polling form as a no-party choice with an end goal to befuddle electors and weaken support for the Democrat in the race, assisting Republicans with keeping up with their greater part in the state Senate.

Florida Power and Light CEO Eric Silagy was straightforwardly engaged with directing assets to dim cash bunches drove by the specialists who controlled Grow United, the association used to advance the apparition up-and-comers, as indicated by archives got by the Sentinel. Holley, the Florida Power and Light lobbyist who conveyed the net metering language to the Senate, attempted to advance Republican Senate up-and-comers in the nearby races. Florida Power and Light denied any bad behavior connected with political missions.

“Any report or idea that we had association in, monetarily upheld or guided others to help any ‘apparition’ competitors during the 2020 political decision cycle is evidently bogus, and we have tracked down definitely no proof of any lawful bad behavior by FPL or its workers,” McGrath, the Florida Power and Light representative said because of inquiries for this story. Records got by the Sentinel likewise show cross-over between Grow United and past missions to upgrade net metering.

One individual partnered with Grow United is Abbie MacIver, who previously worked for Energy Fairness, a gathering that urges policymakers to consider the “cost of energy decisions, as well as their advantages.” Last year, McClure sent a letter to state controllers at the Florida Public Service Commission referring to the outcome and asking it to refresh its net-metering rule.

The commission held a studio, which drew 16,000 messages from sun oriented advocates asking it to let the net metering program be. Officials said it was the most elevated reaction rate they had gotten on any issue and inferred that no prompt changes to net metering should have been made.

“What individuals may not understand is that popular assessment is especially in support of ourselves,” said Bryan Jacob of the Southern Alliance for Clean Energy. “They have the campaigning power, and we have individuals power.”

How the bill came to exist from Florida Power and Light

Bradley, who got Florida Power and Light’s draft bill, is an initial term congressperson who is near Senate administration and seats the Community Affairs Committee and the Subcommittee on Congressional Reapportionment. Bradley is hitched to previous state Sen. Burglarize Bradley, a compelling legislator who was top of the Senate spending plan board of trustees.

Florida state Sen. Jennifer Bradley spoke during a regulative meeting, Thursday, April 29, 2021, at the Capitol in Tallahassee.

Bradley said the bill language arose after a gathering she had with Holley and different individuals from the utility business.

“I checked the language out. It depended on our conversation, and it was one that I could uphold as a beginning stage,” she reviewed.

Messages show that Bradley’s staff circled back to Florida Power and Light after that conversation. On Oct. 8, Bradley’s regulative assistant Katie Heffley messaged Holley with the title: “Net Metering Bill.”

“Good evening, Hope you’re getting along nicely,” she said. “I simply needed to check in and check whether you had any subsequent data or language concerning the net metering charge you talked about with Senator Bradley.”

An email trade between an official associate for Sen. Jennifer Bradley and a lobbyist for Florida Power and Light.

Holley answered eight minutes after the fact: “I do. Might I at any point carry it to you all sometime in the afternoon?” he composed. Heffley proposed that he would be able “email it today or we will be at the Capitol one week from now.”

Holley declined to give an electronic rendition and proposed to “drop it off” face to face the next week. After ten days, Heffley composed Holley once more. “I simply need to connect and check whether I could get an electronic duplicate of the net metering bill so I can place it into drafting.”

An email trade between an administrative assistant for Sen. Jennifer Bradley and a lobbyist for Florida Power and Light.

An email trade between an administrative assistant for Sen. Jennifer Bradley and a lobbyist for Florida Power and Light. [Public records from the Florida Senate]

After two days, Florida Division of Elections records show, Florida Power and Light’s parent organization, NextEra Energy, gave $10,000 to Bradley’s political council, Women Building the Future.

McClure’s political advisory group, Conservative Florida, got no utility cash during this time except for on Nov. 4 got a $10,000 commitment from Associated Industries of Florida’s political board of trustees, Voice for Florida business, which advances Florida Power and Light’s plan and whose experts have additionally chipped away at the dim cash crusades, as per the Orlando Sentinel detailing.

NextEra Energy said its political board didn’t make its commitment to Bradley’s mission “with an assumption for favor.”

These email records were given to the Times/Herald and Floodlight by the Energy and Policy Institute, a guard dog association that attempts to counter deception about sustainable power.

Most states provide net metering

Florida is one of 47 states that allows individuals and organizations to produce energy and to sale it back at a set rate. In any case, those strategies are experiencing harsh criticism as electric companies are against solar and are becoming progressively worried about how homeowners going solar can cut their profits.

In California, controllers intend to increment expenses on roof sun oriented clients. Indeed, even a few natural promoters say the change is fair and important due to the quick pace of housetop sun based advancement in that state.

Housetop sun based, while basic to battling environmental change, is a danger to the customary utility plan of action.

Power organizations like Florida Power and Light bring in cash off of the things they assemble: basically huge power plants and the electrical cables that carry that energy to clients. They don’t bring in cash off of the sun oriented power produced from housetops.

Under Florida’s ongoing plan, homes and organizations that produce under 2 megawatts of sun oriented power can offer the abundance back to their utility in return for a bill credit of 11 pennies for each kWh. Florida Power and Light contends that game plan is uncalled for to clients who don’t produce their own power yet keep on paying for the expenses of keeping up with the network that roof sun oriented clients likewise use.

Housetop sun powered in Florida extended gradually until 2018 when the Florida Public Service Commission permitted power clients to rent nearby planet groups with almost no forthright expenses. That choice slung the development of limited scope sun based limit in the state. It developed by 57% in 2020, as per the U.S. Energy Information Administration.

Florida Power and Light says the expense of sponsoring its 24,000 net-metering clients was $30 million of every 2020 (about $1,250 per client).

The sun oriented industry dissents, highlighting research that shows roof sunlight based entrance is low enough in many states that “the impacts of disseminated sun powered on retail power costs will probably stay insignificant for years to come.”

However, utility specialists have vouched for the Florida Public Service Commission that roof sun oriented in the state could develop at a pace of 39% every year until 2025 assuming Florida’s ongoing net metering framework is left set up.

That development has the utilities, and lawmakers, stressed.

“Because of the ongoing framework, my constituents are being compelled to sponsor the choices of neighbors in different areas who are in a situation to have the option to put these costly frameworks on their homes,” Bradley said.

What the bill would do

Under Bradley’s bill, net-metering clients whose sunlight powered chargers convey energy back to the utility framework would never again get credits in view of the retail cost of energy, yet rather get credits in light of a lower discount cost. That cost depends on the “kept away from cost” that the utility would have brought about if it somehow managed to introduce a tantamount framework.

Draft legislation [Public records from the Florida Senate]

Draft regulation

In order to help minimize electricity imports, the new South Carolina law will allow utilities to charge rooftop solar customers more. The plan also includes expenses such as office charges and least regularly scheduled installments that are unique for these types of clients who use roof sun power before 2023; they would be grandfathered in with their past rates forever!

Florida currently has the second-biggest sunlight based labor force in the nation — around 11,000 direct positions and 31,000 aberrant ones, as indicated by the Solar Energy Industries Association. It positions third among states for introduced sunlight based limit, albeit quite a bit of that is huge scope, utility-possessed sun oriented.

Justin Vandenbroeck, the leader of the Florida Solar Energy Industries Association who likewise claims an Orlando-based sun powered establishment organization, said the sun oriented industry comprises for the most part of autonomously possessed private ventures. “Assuming that this bill passes for what it’s worth, it can possibly send Florida back to 2013, as though the advances of the most recent 10 years didn’t occur,” Vandenbroeck said.

McClure states the bill “isn’t prepared.”

“From the get-go in this bill’s ride, I think it has a genuine opportunity to settle out such that most gatherings are not vexed,” he said. He added that the net metering regulation has not been refreshed in 13 years and presently is an ideal opportunity to talk about it.

“We really want to have the discussion,” he said. “I’m not apprehensive in the event that the end is it’s not an opportunity. I feel housetop solar is advantageous to the climate, and Floridians. I’m worried that it will bring about tremendous expenses here, yet I likewise don’t have any desire to annihilate the roof sun powered industry in Florida.”

Katie Chiles Ottenweller, Southeast chief for Vote Solar, an Atlanta-based support association, is hopeful yet watchful given Florida Power and Light’s clout in the Florida Legislature and its job in drafting the bill.

“Organizations don’t pass regulation. Lawmakers pass regulation,” she said. “I’m confident this is an ice breaker be that as it may, simultaneously, it’s truly difficult to have a discussion when you have a firearm to your head. The bill as it is composed will demolish this industry.”

1 thought on “Florida’s Largest Electric Company FPL Is Against Solar Power”

You’re so cool! I don’t think I’ve truly read a single thing like

this before. So great to find someone with some unique thoughts on this topic.

Really.. thank you for starting this up. This site

is something that is required on the internet, someone with a little originality!