Request for increase in electricity cost

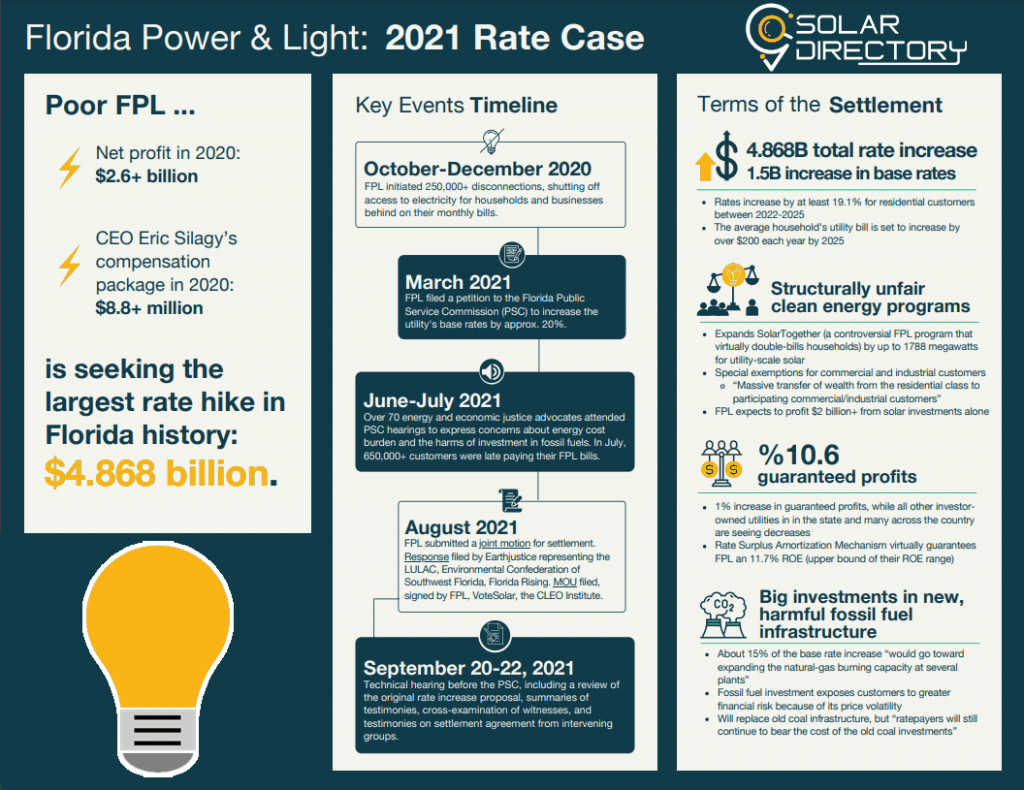

Last March, FPL filed a proposal with the Florida Public Service Commission to increase electricity cost by approximately 20% over four years. In late October they approved an agreement that will allow them to raise your monthly bill up $215 each year until 2025. This rate increase will have a dramatic effect on over 11 million Floridians served by FP&L.

According to News4Jax the utilities intention is to improve the infrastructure and grid resiliency.

“The plan will allow us to continue to make proven investments in infrastructure, clean energy and technology that benefit our customers and a growing state,” said FP&L CEO Eric Silagy.

The people fighting the rate hike criticized FP&L for trying to raise rates while more than 650,000 of its customers are still struggling.

“What’s reliability if you can’t afford to keep the lights on due to a high bill?” said Jordan Luebkemann with Florida Rising.

Background

The utility companies in the United States are regulated monopolies, which means they have a captive customer base and can earn guaranteed profits. The group of commissioners who monitor these activities ( nominated by state legislatures) sets regulations for services provided as well

monitors how much money is being made off each person that relies on this company’s product or service

Florida Power & Light is the largest monopoly in the state

With their monopoly status and $2.65 billion net earnings in 2020, FPL’s president received an 8x compensation package from residential customers who make up the largest source of company revenue since 2016–55%.

Fluctuating electricity prices have been difficult for Floridians to afford especially with many already struggling to afford many other monthly bills.

Energy insecurity is a major issue for communities of color and low wealth. These groups often have to make difficult choices between paying their power bill or buying food, medications etc., which can lead them into even more hardships like inadequate housing and trading off between other expenses like medications, childcare, or food.

When times are tough, we have to take care of our people.

A hike in electricity prices is never an easy thing for anyone but we need to care for our people by keeping FPL rates low enough allowing everyone with access to necessities like electricity.

As advocates work to protect communities from disconnection, they are frustrated by FPL’s lack of commitment. After three short months with no progress on behalf of its customers who finds themselves behind on their monthly bills due to unpaid electricity debts as a result of the rising electricity cost—FPL resumes shutoffs once more! There is no industry standard or government mandate requiring utilities release public information about these cancellations; it’s reported inconsistently and advocate often have pieces data only including fractional populations impacted high burden energy services essential maintain security well-being.

The environmental injustices that affect minority communities and low-income households are often not addressed by traditional methods. The Partnership for Inclusive Energy Security (PIES), in partnership with grassroots organizations across the country, has been working to bring these issues center stage so they can be remedied through sustainable changes within our energy system itself.

This means prioritizing renewable resources like wind or solar power while eliminating fossil fuel investments altogether; it’s something we need now more than ever before because climate disruptions will only get worse without intervention!

Photo caption: In a show of solidarity, community groups and Miami residents have come together to peacefully demonstrate outside FPL’s offices. The group planted 250 flags—one for each lost electric customer–to remind the power company that its moratorium on shut-offs is not acceptable anymore!

FPL is not the only bad actor

Nine out of ten small businesses have been forced into insolvency due these policies.

The utility companies across this country recently wielded their political power by securing beneficial tax code change which will allow them relief from paying off billions worth debt while giving little back to the community.

The economic stimulus bill was supposed to support those struggling amidst the COVID-19 pandemic. With money utilities spent on executive pay and dividends, many could have bailouts their customers more than 500 times–but none of that utility dollars were used to relieve households’ or small businesses’ debts!

Proposed Rate Hike by FPL

The utility company is required to “ask” regulators for their approval over a series of regulatory proceedings called rate cases. Utilities have continuously increased electricity cost, revealing that this process is deeply flawed with abuse and capture by corporations who force households across the country into high expense due in part from an inefficient system which must be paid back through higher prices or taxes on consumers’ behalf.

FPL is seeking approval from the Florida Public Service Commission to increase electricity base rates by approximately 20% over four years. The company has submitted a proposal that will be heavily fought out in March 2021, when hearings begin on this case and others like it across state lines for months at time before they reach overlapping conclusions (or not).

FPL’s defense of proposals to invest in new fossil fuel infrastructure by blaming growing demand for electricity and oversimplifying funds allocated towards outright unjust clean energy programs is not convincing the public. In fact, FPL consistently brushes off responsibility when it comes down systemic issues with our country’s current energy system; instead placing all blame on ratepayers who will be harmed as this case progresses!

FPL’s claim that they are “proud to keep typical residential electricity cost well below the national average through 2025″ is not true. According to Catalyst Miami this statement relies on an unrealistic and false assumption of 1,000 kWh per month usage by every utility company client-a statistic which applies only for FPL’s performance when compared with other large investor owned utilities like Duke Energy Corporation (Duke).

In short: “FPL doesn’t even come close.”

How You Can Fight Rising Electricity Cost

According to energy.gov homeowners can combat the hike in electricity cost by becoming independent from the proposed FP&L rate hikes and go solar. Thanks to the Solar Energy Technology Office’s investments, residential solar is much more affordable than electricity.

“Unfortunately, many homeowners don’t know enough about solar and tend to shut it down before knowing anything about it actually. They hear from someone that it cost a lot of money and never really give it any thought.” – Florida resident Raquel Silva.

Learn more about solar and its benefits

Researchers are urging homeowners to treat solar with an open mindset and to truly give it a chance before shutting down something that they know little about. There is a reason that Florida’s largest utility company is against residential rooftop solar.

Most homeowners that go solar in fact save from day 1 on their electric bill and did not have to dish out any upfront money.

Want to learn more about the benefits of solar for you and your family?